TikTok has exploded into the world’s most popular social media platform, with millions of users around the globe creating and sharing videos with friends and strangers. The app’s popularity has spurred copycats, and competition is fierce from big digital ad companies like Facebook parent Meta Platforms and Alphabet’s Google. Investing in the short-form video company may be a smart move, but it’s not without risks.

Unlike many of the tech “unicorn” brethren that command multimillion-dollar valuations before launching their much-anticipated IPO, TikTok remains private. If you’re interested in buying shares in the company, it will require some extra research and due diligence on your part. That’s because a private company isn’t subject to the same disclosure requirements as a publicly traded firm, and you won’t have access to quarterly earnings reports or other financial information. The company is also highly speculative, as it faces several potential hurdles that could derail its growth.

For example, a recent ban on the app in the US has raised concerns about internet censorship and freedom of speech. In addition, the company’s owner, ByteDance, owns stakes in other tech companies, so the ban could have a ripple effect on those firms as well.

Another factor that could delay a TikTok IPO is the US government’s fear that ByteDance will share private data from millions of Americans with China’s Communist Party. The company has responded to these fears by establishing Project Texas, which will protect the data of US TikTok users.

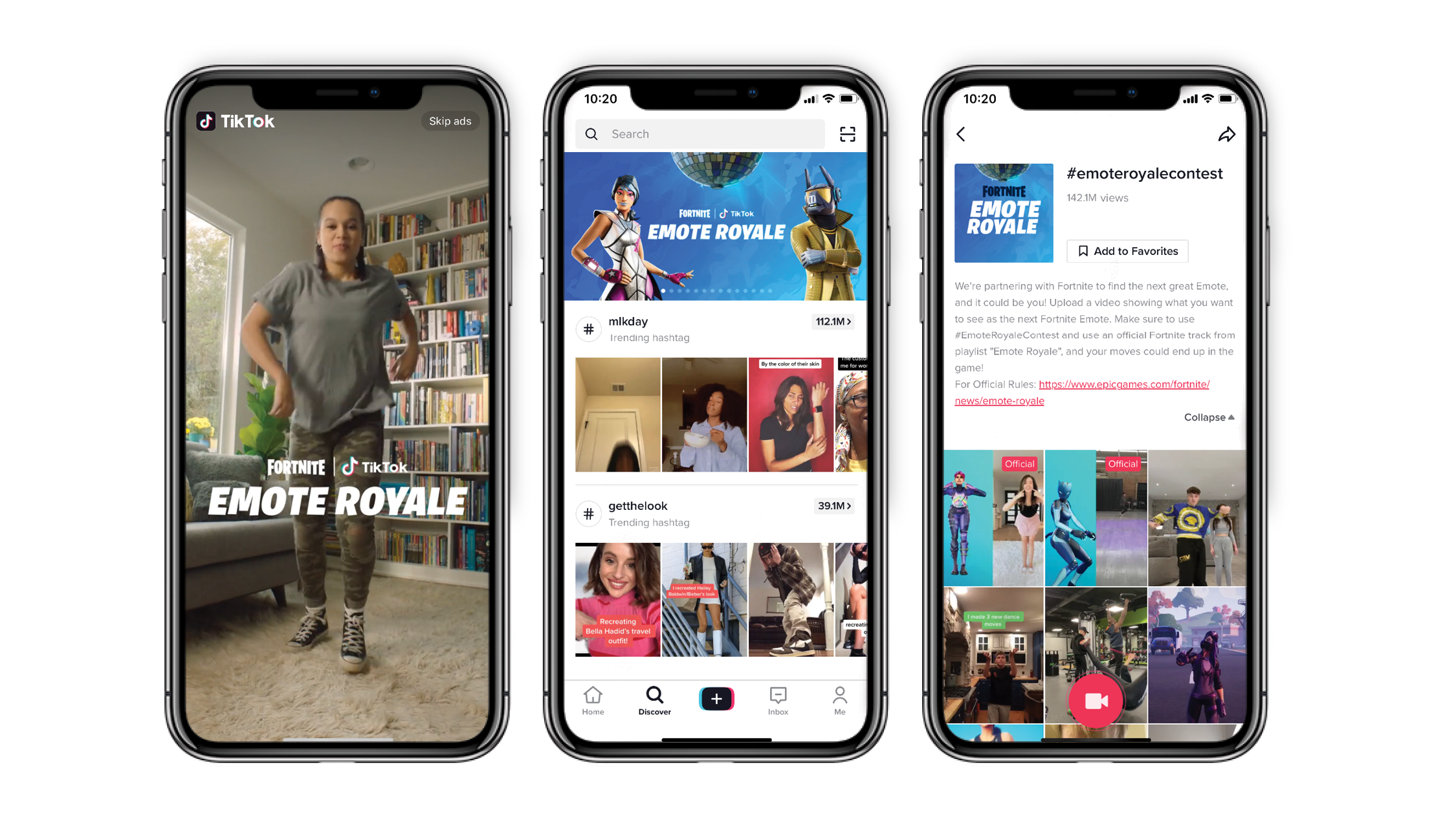

Despite these challenges, the company still has a strong market position. The platform generates huge amounts of revenue and has been downloaded more than three billion times, Business of Apps reports. It’s also a popular choice for gamers, as it offers an easy way to show off their skills and connect with other players.

If you’re interested in investing in the company, there are a few ways to get involved. One option is to reach out to investment firms, such as EquityZen and AngelList, that specialize in connecting investors with private companies. These firms can help you find deals and connect with companies that want to sell stock. They can also help you understand the pros and cons of investing in private companies.

Another option is to wait for TikTok’s public debut. However, this could be a long process. Private markets can be complicated and require approvals, legal purchase agreements and wire transfers between parties. It’s recommended that you work with an experienced broker to ensure a smooth transaction.tiktok share price